The Definitive Guide to Retirement Income Planning

Table of ContentsRetirement Income Planning Things To Know Before You BuySome Known Details About Retirement Income Planning Retirement Income Planning Things To Know Before You BuyThe Single Strategy To Use For Retirement Income PlanningAn Unbiased View of Retirement Income PlanningThe smart Trick of Retirement Income Planning That Nobody is Talking About

There are a variety of questions that require to be answered when you're preparing retirement earnings. 1) Identifying when to retire is a vital element in intending your retired life income. While this inquiry may not be easy, it is very important to evaluate every one of the numerous elements to provide you the opportunity of the very best retired life feasible.Period Specific This choice permits you to receive a repayment for an established variety of years. Also if you die before the complete time period, your beneficiaries will certainly proceed to receive the annuity. Lump Amount This alternative permits you to select an one-time money repayment currently, for no further payments.

4) When intending your retired life revenue, it's necessary to take taxes into consideration. Eventually, there are 3 various tax treatments in retirement. The very first therapy is taxable money, which need to be reported on your tax obligation return as well as undergoes tax obligation. Instances consist of rate of interest made in bank accounts as well as taxable gains on stock in a brokerage account when you sell it.

What Does Retirement Income Planning Do?

Your tax-deferred accounts are accounts where you didn't pay tax obligation on your contribution or seed cash. Rather, when you draw cash out of these accounts, your withdrawals will certainly be strained as normal income.

With a tax-free account, the tax obligations were paid on the contribution, so development and withdrawals are not tired, as long as you abide by internal revenue service regulations. Instances of tax-free accounts are municipal bonds, Roth IRAs, as well as certain sorts of cash money value insurance policy - retirement income planning. With a clear income strategy that takes tax obligations into account, it might be possible to proactively lower your tax expense during retirement.

A Biased View of Retirement Income Planning

This is cash you're depending upon accessing in the short-term. retirement income planning. You'll wish to protect this cash from market volatility and also select extremely conservative economic instruments. This bucket holds money you won't require to gain access to for 4-6 years. It holds traditional investments that will replenish the short-term container when tired.

6) Among the biggest assets many Americans have is their house. For some Americans, a feasible technique is to downsize their home by offering it, and afterwards use a section of the gains to fund retirement. Uncle Sam has actually made this approach work from a tax perspective. Currently, if you are married, you can excuse up to $500,000 of gains when you market your house (this exemption is allowed every 2 years).

Despite why you function, the added revenue you create will also be consisted of in your strategy as it can reduce the quantity of possessions needed to attract down for cash flow.

Some Ideas on Retirement Income Planning You Need To Know

This is a foundational income source for most people. When you decide to take it might have a large influence on your retired life. It can be appealing to declare your benefit as soon as you're qualified for Social Securitytypically at age 62. But that can be a costly action.

(FRA arrays from 66 to 67, relying on the year in which you were birthed.) Figure out your full retired life age, and also work with your financial specialist to check out how the timing of your Social Safety and security benefit fits right into your general plan. Although pension plans utilized to be commonplace, they aren't a lot anymore.

1 If you are among those individuals, you'll wish to weigh the benefits and drawbacks of just how you withdraw the moneyas click to read a round figure or stream of earnings. If you do not have a pension, there are various other means to develop a pension-like stream of income.: A set revenue annuity is a contract taken care of by an insurer that, in return for an upfront investment, guarantees * to pay you (or you as well as your spouse) a collection quantity of earnings either for the remainder of your life (as well as the life of a surviving partner when it comes to a joint and survivor annuity) for a set time period.

Some Known Facts About Retirement Income Planning.

Furthermore, there are options to give a benefit to your successors, if that is an read this article alternative that is essential to you. While each sort of annuity can supply an eye-catching mix of functions, job with your financial professional to assist identify which annuity or a mix of annuities is appropriate for you in developing a diversified income strategy.

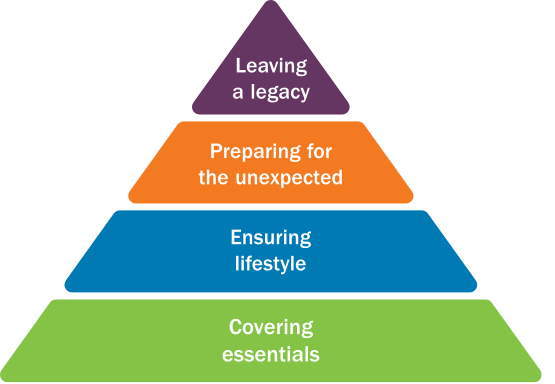

You'll intend to think about just how you can pay for those fun points you have actually constantly dreamed regarding doing when you ultimately have the timethings like getaways, leisure activities, as well as other nice-to-haves. It's a wise method to spend for these sort site link of expenditures from your investments. That's since if the market were to do poorly, you could always cut down on several of these costs.

Everybody's circumstance is one-of-a-kind, so there's no one income method that will certainly function for all capitalists. You'll need to figure out the relative significance of growth capacity, assurances, or versatility to aid you determine the method that is right for you in retired life.

The 7-Second Trick For Retirement Income Planning

Retired life planning considers not only assets and income yet additionally future expenditures, obligations, and life span. If you are under 50, you can add an optimum of $20,500 in 2022 to a $401(k). In the easiest feeling, retired life preparation is what one does to be gotten ready for life after paid job ends.